Scam And Cons

Fraudsters, scammers, con artists, miscreants, whatever term you want to use, they will at some point target all of us. By the law of averages if they contact enough people, they will find someone that will fall victim to their scam. There are no particular targets for scammers:

- Age.

- Gender.

- Health-status.

- Disability.

- Ethnicity.

- Religion.

- Race.

- Income (Employment-status, Benefits-recipient, Pensions, or Retirement).

If you have an identity, and or, money, then you are fair game, and we all have both. One of the many ways that scammers contact their victims, are via the phone (Vishing), or text messaging (Smishing – SMS Message Phishing), other ways include websites or email (Phishing), and social media is one of there major hunting grounds.

Every month, there is a news story about some type a scam that is doing the rounds. Since covid 19 the way we interact has changed, and so has the scammers behaviour. Listed below are just a few of the different types of scams we hear about.

Phone and text message scams have become more common, a parcel delivery scam, a text is received with a link to pay a small delivery fee.

The inland revenue has contacted you and that you are due a tax refund with a link enclosed.

A phone call is received, “supposedly” from the bank, or, another financial institute, regarding suspicious activity on your bank account, due to your account being compromised, and you need to move money to a (“SAFE ACCOUNT”), which the bank will never ask you to do.

You receive a call “supposedly”, from the police, you have become part of their investigation, as there has been some form of arrest, due to some form of illegal financial transaction and they are requesting further information.

A phone company calls you with regards to a new mobile phone offer(the most common), and that if you change your phone contract, “immediately”, they will “pay of your old contract”, and give you a brand new phone, “but”, it is time limited and has to be completed immediately to secure the best offer.

The unfortunate consequence is that in many cases the person that falls victim to the very well-crafted and targeted fraud will be caught off guard. As human beings we are mostly conditioned to trust, help, and support other through our up bringing and education, and this is a “good thing”, to show care and compassion to others, “BUT” fraudsters know this.

What you must NOT do is panic

What I am about to say here may to many seem very rude, and goes very much against our up bringing, but, what we have to do is re-condition out thinking, and behaviour, because when someone calls, emails, texts, or may visit out property that “you do not know”.

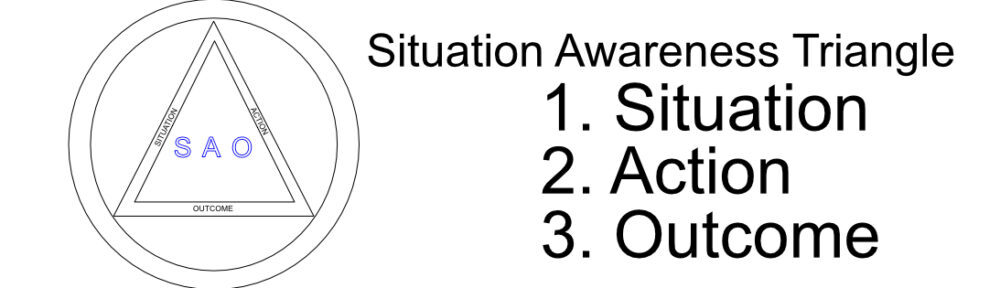

You have to be suspicious, and you have to be aware of what is happening around you. If some one calls you claiming they are from the bank, and says that you have had your bank account compromised, and that you are about to lose all your money immediately you go in to “panic mode”, and scammers know this.

Threats, fear, intimidation, is the behaviour that will get you to worry and panic more, and get you to do something immediately and rash so that you can protect your money. In this mindset you are not thinking rationally, and that is exactly what they want.

Let's think about some point here

- You have to ignore them

- You have to cut them down by saying “NO” BUT, be polite.

- Hanging up calls.

- Distrust, IE not trusting what they will say is true.

- You don’t respond to text messages.

- You don’t click links in emails and text’s.

- You must delete any and all emails.

- The best thing to do is not to respond, don’t antagonise, don’t cause conflict say NO AND HANG UP.

- If someone you don’t know comes to your door, don’t open it. Look through the window and ask what they want

- Keep doors locked.

- If they claim they are from a supposedly trusted source, ask for ID.

- If they don’t have any ID simply, keep the door locked, and inform them that you are checking with the company, but don’t use any numbers they may give you, if they are genuine, they will understand

Solutions: What to do next

If you have received that call, text, email or letter, don’t respond to any information that you are given, don’t open or trust any links, don’t trust any information they give you because they are re-directing you to another scammer, if they say that the number on the bank card matches the number they are calling from it is bogus, fake, not legitimate consider the following

If in doubt and you have to contact someone such as a bank, phone provider, TV licencing, HMRC, etc to name a few…

You “must” use a trusted source to contact that company.

You can, get a contact number from a bill, or trusted letter.You can google the company.

You can ring directory enquiries.

You can use yellow pages on line.

But, “don’t, don’t” use any numbers they give you.

Don’t use any links provided.

Don’t use any email address they give you.

Tricks and Tactics

How can they illicit information from a victim, that can be used later to start a targeted attack, a common method is done on the phone.

Generically you receive seemingly innocuous phone call, this will be a under the pretext of wanting a few minutes of you time so they can answer a few questions, survey’s are a great way to ask you information without drawing attention to” their” intentions, there will be a mix of health and lifestyle as well as at some point asking about financial products, insurance, shopping habits etc, there may be income based question but, there may not.

They may well ask for name, an email address, and or a phone or postal address this will be under the pretence of sending you a mail shot and keeping you up to date with products and services, this is just looking to get more personal data.

This can be done in the street, using the same tactics and tricks. This is an in-person method, but, due to this approach it appears to be legitimate and benign, but all they want is your personal details.

What they don't want you to do is

Not wanting you to talk to others and tell them what his happening, during the COVID-19 pandemic this was a lot easier do to social distancing, and social isolation.

They don’t want to give you time to think, using urgency, pressure, or risk, they want you to make a quick decision, this is a very common tactic (not giving you time to think not allowing logic to see the bigger picture) because when you do, logic will allow you to realise it’s a con.

Is get you to psychologically agree with them, without you realising it happens, convincing you that you do want to do this. This works by the phrasing used and getting you to agree. When talking with you they may well finish a sentence or a statement with a “yes don’t you think” or something along those lines, so by the end of the call you are being psychologically groomed into agreeing with the caller, and that is easier to get you to do what they want.

Prevent them from getting access to your money, or identity. How they get access to your device, applications, and or financial information is to get you to install a program on to your computer, tablet or phone. Once this program is on your device, then technically they can have control.

To not get your money, and this doesn’t actually mean that if you don’t give them your credit cards, that you are not going to give them your money. They may ask you to buy gift cards and share the code number from under the scratch panel. They may be requested to be used as part of a fine, or dept that needs to be repaid.

Is to decline or refuse their behaviour, they may well use threatening, abusive, bullying and otherwise aggressive behaviour. This has been a tactic where they threaten that they will visit you property, or visit a place of work. ( If this happens call 999 immediately).

Don’t want to wait to get access to your finances, a common trick is to claim there calling from the bank, to stop a fraudulent transaction, and, to stop said transaction then they will sand a code and you need to share that code with them. A Request that you share codes that you are sent via text messages, that appear to be from the bank to stop fraudulent transactions, simply allows them to access and or transfer money to their accounts.

For more information:

You can visit Action Fraud a great place to start, or you can text scam text message to 7726, which spells SPAM, on a mobile phone. A great research site is the BBC Scam Interceptors documentaries